Bishop Hill

Bishop Hill Men of no meaning

Dec 7, 2013

Dec 7, 2013  Climate: Sceptics

Climate: Sceptics  Greens

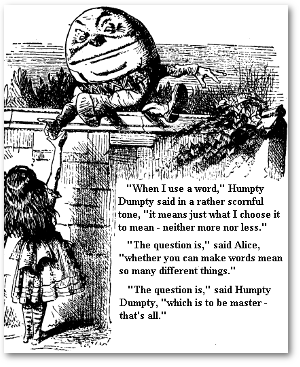

Greens  James Delingpole is on vigorous form, in a groove that this blog also treads from time to time, namely the misuse of the English language to score political points. His particular complaint is the "let's all pretend that fossil fuels are subsidised" meme that many of the more ludicrous members of the green fraternity find so attractive at the moment:

James Delingpole is on vigorous form, in a groove that this blog also treads from time to time, namely the misuse of the English language to score political points. His particular complaint is the "let's all pretend that fossil fuels are subsidised" meme that many of the more ludicrous members of the green fraternity find so attractive at the moment:

This fossil-fuels-more-subsidised-than-renewables meme has been spread, inter alia, by the Guardian's ludicrous Damian Carrington; by Labour MP Barry "Dork Brain" Gardiner (Vice President of the sinister GLOBE international); by green pressure groups; by the Overseas Development Institute; and by the IMF which, impressively, has put global energy subsidies at $1.9 trillion – the majority of these, apparently, for fossil fuels…

This is undoubtedly an abuse of the English language and one so egregrious that even the noble and learned Baroness Worthington has found herself unable to support it.

As I've said before, if you don't use words with their common meaning then nobody can trust a word you say. So when peers and MPs who make these claims about fossil fuel 'subsidies' tell you they have 'no conflicts of interest', that they only make 'honest expense claims' or that they 'didn't have sex with that woman', you should probably assume the worst.

Reader Comments (64)

The erroneous notion that a reduced rate of taxation for anything, cf VAT exemptions, is a subsidy should be attacked and clarified by any Tory government. Sadly, we do not have one and few of the 'senior' politicians follow Tory principles.

The final paragraph says it all:

The real fossil fuel subsidies lie in the vast amount of taxation, duties and royalties that the industry provides to governments. Anyone who is employed by government or benefits from government spending is on a "fossil fuel subsidy"

Fossil fuels are subsidised, in the true sense (keeping fuel prices low) of the word, across the world.

The 10 biggest subsidisers (2011 figures), according to the Institute for Energy Research are: Iran, Saudi Arabia, Russia, India, China, Venezuela, Egypt, Iraq, the UAE and Indonesia.

No wonder they want the West's climate indulgences.

Rick Bradford, very well put. And see how many of these countries are in the muslim world.

Rick, that is a subsidy to consumers, not producers.

I suppose one can argue that there is a knock on benefit to producers, but not so much in countries like Saudi, UAE and Venezuela that export most of their oil to non-subsidising countries.

You are correct about some of those countries turning up at climate change conferences demanding that the West commit economic suicide without offering anything in return.

The IFS at it today;

"The IFS said that although the temporary measures introduced by Chancellor George Osborne in the Autumn Statement, including a move to cap business rate rises next year at 2pc instead of the higher retail prices index (RPI), were welcome, using quick-fix policies risked making firms dependent on a form of SUBSIDY."

Telegraph

"Didn't have sex with that women": bit of a Freudian slip there by the Bish. Got something to tell us?

ssat

I noticed that as well but I think the phrase "form of subsidy" just about lets them off the hook.

In political terms you can argue that anything that un-levels the playing field can be described as a subsidy. I am unhappy with some of Osborne's proposals for town centres, for example, because in some areas he is — in effect — giving support through the tax system to those prepared to re-open empty shop premises. While this may be a good idea on paper it will almost certainly a) keep that shop open only as long as this discount/bribe/favour/subsidy is in place, and b) result in the closure of other premises in the same line of business which are not in receipt of this discount/bribe/favour/subsidy.

But on this basis the only subsidies that are available to the energy industry are those paid to the producers of renewables who are guaranteed a price for their product and guaranteed a price when they don't produce while their competitors have or are about to have additional tax burdens loaded onto them in the form of carbon taxes.

Rope and lamp posts.

Rope and Lamp Posts.......

Great comment by Fenbeagle: 'Stupidity is renewable'.

Some people really would stop 'subsidizing' a goose with grain when it was laying golden eggs.

I walked to the shops today with twenty pounds. I was not mugged or robbed by anyone, so was able to make my purchases and return home with all the change. I would like to thank the criminal fraternity of my town in subsidising my purchases of bread and milk.

Another thing about the UAE is that there is *no income tax* except on banks and oil companies which are taxed at flat rate of 50-55%.

In addition, the state takes royalties on oil production. Pretty much everything is funded from those sources.

So when one includes UAE (pop 9.2 million) as a country that gives "fossil fuel subsidies" because fuel is cheap there, it is still a gross distortion.

Taking money from one group (power company customs) to redistribute it to another (wind farms) = subsidy.

Being allowed to keep more if your hard earned cash (profit or even wages) so you can invest/spend/save it as you wish = NOT a subsidy.

It's it really that hard is it?

Regards

Mailman

BH - "This is undoubtedly an abuse of the English language and one so egregrious that even the noble and learned Baroness Worthington has found herself unable to support it."

I wonder if a description of something - or someone - which is opposite to all evidence of its actual qualities is even more of an abuse of words than manipulating the meaning of them? It may be open season in this, but if we are to say what we mean isn't it best to not say what we don't?

In 2012, Exxon paid $102.1 billon in taxes and resource royalties to governments around the world. That is not a small amount of money and it even exceeds the total GDP of most countries.

Name a green industry that pays anything.

Sorry not to join the party, but I can't get particularly exercised at using "subsidy" to refer to providing tax favors preferentially to one group--inevitably, at the expense of others. To the extent that an energy company gets a tax deduction for being an energy company, then it doesn't offend me for the other taxpayers to feel they've subsidized the energy company with the higher tax rates that inevitably result.

Much less defensible, to my mind, are two other misuses of the word.

The first, arguably lesser, misuse is failing to express the subsidy in terms of dollars (euros, whatever) per megawatt-hour (joule, BTU); stating it that way would make the relative level of subsidy more understandable.

The second, arguably greater, misuse is to call a deduction a subsidy when all other businesses get it, too. If everyone gets the same deduction, no one is getting subsidized.

In the case of the oil-depletion allowance, we have a hybrid. Largely, it's just like depreciation, i.e., recovery of a capital expenditure, to which all businesses are entitled. But oil companies can elect to do it in a way in which the total allowance over time ends up exceeding the investment. To the extent that this happens--and I have no idea how great that extent is--then I am not offended by calling the result an effective subsidy.

Of course, those who complain about energy-company subsidies rarely make such nice distinctions.

Joe

UK - ALL energy (renewable or fossil fuel) gets the same treatment with respect to VAT to the consumer..

lets lobby the government to stop subsidizing food shall we (ie charge FULL VAT)

There are clearly many ways in which governments interfere with fossil fuels production and supply etc. The OECD has a report entitled Inventory Of Estimated Budgetary Support And Tax Expenditures For Fossil Fuels, OECD 2011, which is pretty dull but includes lots.

There are some clear way in which FF are supported that you lot will disown like the cost of military action to keep trade routes open and oil exporters friendly, the cost of treating the negative health effects from emissions amongst others. And of course with US shale being sold at below the cost of production, users get a huge subsidy from shale investors.

Dec 7, 2013 at 9:49 AM | Unregistered Commenter G. Watkins

You are mistaken to say that Cameron and senior politicians are not following `Tory principles'.

That is precisely what they are doing.

But those principles are not conservative with a small c.

Joe Born, Barry Woods -

I agree that a subsidy can be implemented as a reduction in tax. For example, if the government wishes to support a domestic chocolatier, they might set a VAT rate of 5% for Cadbury chocolates but a 25% rate for Hershey's. This is easily seen as "protectionism". A differential between complementary goods is likely a subsidy. In the case of energy VAT tax, it is applied equally, so should not be considered a subsidy. ROCs, on the other hand, clearly are.

Chandra -

Equivocation of "subsidy" to include purely commercial dealings is even sillier. One may call it a transfer of wealth, but surely subsidy is the realm of the State solely.

Security of affordable energy supply is what keeps you on this page, warm in your house, able to see at night, use public transport etc etc. Security of trade routes is what helps wind turbine parts from China make it to the UK and the raw materials to make it to China in the first place. Affordable fuel and power is what transports it to location and powers the factories that built them.

When countries start taking military action to protect (or attack) renewable energy supplies, you'll know it's actually considered worthwhile. .

The only example I can think of is Hydroelectric. Think Dambusters. Of course, if only the Allies could have mobilised the German Greens 30 years before their time, they needn't have bothered. They would have prevented the dams from being built in the first place. And can you imagine any country being seriously worried about the power shortfall should their wind turbines be attacked?

You really need to read this to get a flavour of what a "subsidy" is:

http://www.globaldashboard.org/2012/12/04/the-problem-with-fossil-fuel-subsidies/

If commodity A is taxed at 20% and commodity B is taxed at 20% you do not have enough information to calculate any subsidy yet. If the tax on A is all VAT and the tax on B is 5% VAT and 15% "other" then B is being subsidised at a rate equivalent to those 15 percentage points. It is really quite creative.

The difficulty I find is finding it within myself to assume the best of any MP - maybe in one or two but they're the exception. These days I deem that, the noun 'politician' brings me to cognitively conjure various depictions including such as; liar, peculator and mountebank amongst other more choice pejoratives.

The last time I checked, no country in the world had passed a law to COMPEL any person or any company buy electricity generated from fossil fuels or nuclear power. The same cannot be said of wind- or solar-generated electricity.

Compulsion is worth an awful lot of subsidy.

I think Dellers is playing with words. Let us assume that instead of offering subsidies to the renewables industry the government reduced its tax burden by an equivalent amount. It could claim, in Delingpole's interpretation, they were not subsidised. In this day and age with complex tax systems a better definition of 'subsidy' might be: to offer a company operating in a particular field a finanancial advantage not generally available.

michael hart

With the greatest respect I don't think your example is helping matters.

If you are feeding corn to a goose and she is laying eggs in exchange that is not a subsidy but a business arrangement.

If you are feeding her corn and she is laying golden eggs then I would be tempted (I'll resist!) to suggest that she is subsidising you.

I don't agree totally that a tax break cannot be a subsidy. Where government uses a fiscal means to favour one group as against another directly competing group (see my example about the plan to suspend business rates on re-opening shops) then it seems to me that the word 'subsidy' is a perfectly legitimate one to use.

The point surely is that when it comes to oil, gas, wind and solar the playing field is level as far as the consumer is concerned (VAT is levied at a lower rate across the board) but not as far as the supplier is concerned and the balance, far from 'subsidising' fossil fuel companies penalises them with additional taxes while the renewables companies are given guaranteed payments whether they produce or not. And that is a subsidy.

Our dramagreens, however, since they are "saving the planet" presumably think that shovelling subsidy into windfarms is OK (like feeding michael hart's goose!) but that fossil fuel use should be taxed at 20%. 'Hard of thinking' doesn't start to describe it.

The David Steven article that graphicconception links to is well worth reading and filing as the basis of a riposte to those who argue that fossil fuels are more heavily subsidised than renewables.

kellydown,

"And can you imagine any country being seriously worried about the power shortfall should their wind turbines be attacked?"

I guess that is the one advantage of tapping a highly diffuse energy source. It would take a lot of bombing missions to destroy the damned things.

Can we agree:

Tax -- transfer of wealth to the government

Subsidy -- transfer of wealth from the government

A reduced tax and an increased subsidy can manifest the same change in government finances;

HOWEVER, a subsidy can support a non-economic activity whereas a tax can never be paid by one.

James

@James:

Couldn't have said it better! If I'm pursuing a non-profitable activity, even a tax reduction to zero will not keep me above-board as I keep spending more than I'm earning. But if I receive a subsidy, that might be enough to turn my activity into a profitable one (especially if the spending part is negligible, as in the well-known case of farmers being paid subsidies for disusing their land).

So true subsidies can keep non-profitable enterprises afloat (and by doing so, keep wasteful and stupid activities alive), while tax exempts can only increase the profit margin of an enterprise that's writing black figures anyway: Everybody knows that if you're living at the brink of poverty you don't pay income tax anyway, so a tax reduction won't help you - a subsidy bringing in some extra cash that you haven't earned OTOH certainly would.

A superb comment by "Dropstone' on Dellers' blog. I haven't corrected any typos because the meaning is quite clear. (He forgot to mention the humble'wellsitre geologist'...)

dropstone

UK Offshore oil industry taxes.

For those stale smelling hippie lefty greenies, some basic facts:

Corporate Tax paid by the offshore oil industry 2009: £13 billion

Average Oil Orc salary 2009 : £50 kpa

Average tax take from evil oil orcs : £19kpa.

Then of course you have VAT on petrol, fuel oil and gas as well as duty on said products.

'Tis not we evil oil orcs who are 'subsidised' with 'tax breaks'. It is us, the evil oil orcs whose largesse permits the flourishing of Diversity officers , 5 a day coordinators, climate change advisors and other , lefty, greenie, parasites.

All stand in humble recognition of the heroic Roughnecks, Rousties, directional drillers, Mudmen , mudloggers, MWD Hands, welders, sparkies, toolpushers, camp bosses and stewards etc. Who keep this nation from drowning in its own bullshit.

.

Amen, Amen.

Jimmy Haigh And dropstone,

x 1,000,000

Chandra: "And of course with US shale being sold at below the cost of production,"

"Drillers in Pennsylvania pay a so-called impact fee to the state and local governments – drillers have paid more than $400 million since the fee was imposed in 2012 "

Texas: Severance Tax Rates

Gas: 7.5% (.075) of market value of gas.

Condensate Production Tax: 4.6% (.046) of market value of condensate.

Regulatory Fee: For report period prior to September 2001, 1/30 of a cent (.000333) for thousand cubic feet of gas produced. For report periods September 2001 and later, .000667 for thousand cubic feet of gas produced."

To those who claim that differential tax rates can be described as subsidies - no, no, no! That is precisely the slippery slope of language perversion that Dellers and the Bish are rightly criticising.

Are differential tax rates unfair? Quite possibly. Bad policy? Very likely. But they are NOT the same thing as a subsidy.

A subsidy is quite simply a transfer of cash - real money - not a lessening of an obligation to pay. And subsidies can occur in private enterprise, such as when a loss-making business is propped up by a profitable one in the same group.

Fossil fuel energy suppliers subsidise "renewables" through the massive taxes they pay, some of which are handed over to wind and solar suppliers. Their customers also subsidise "renewables" directly, through the higher prices they pay because of mandated quotas which are economically draining on the companies that are forced to install or buy them.

There is plenty of subsidising going on in the energy industry, but it is the opposite of the utterly dishonest mantra of the ever-grasping anti-capitalist greens, who never saw a dollar of other people's money that they didn't feel entitled to.

There is an oft-repeated nonsense here in Australia (based on a paper published in the journal Energy Policy) that coal mining is subsidised because the diesel fuel used in mining is exempted from fuel excise. The rather obvious point missed is that fuel excise was introduced and continues to be applied to recover the cost of providing roads. (One can argue over whether this is the best means of financing roads, and whether hypothecated revenue is a good idea, but that is beside the point). The exemption also applies to fuel used in farming. The point these dullards miss in their attempt to show that coal relies on subsidies is that those using it do not use roads, and so they have been able to defend an exemption. You see, it is subsidised because the government doesn't tax it to pay for something it doesn't use.

Let me give you another example based on my understanding of the rules:

Commodity A is taxed at 20% VAT. Commodity B is taxed at 40% - 15% VAT and 25% other.

Commodity B is being subsidised by these rules because 20%, the norm, is greater than the 15% special rate. The extra 25% does not count anywhere.

So you can be paying more tax but it can still count as being subsidised.

Please tell me if I am not understanding something.

Aynsley, the same absurd claim is made about the diesel fuel rebate for vehicles used by farmers on their own property. People who believe that farmers are "fat cats" falsely claim that this is an example of a subsidy.

Those who say "subsidy" is purely the realm of government should reflect on it as they enjoy their Christmas bash, subsidized no doubt by their employer.

Those who think only a cash payment from a government represents a subsidy presumably think there is a difference between the gov charging 20% tax and then giving half back and the gov just charging 10%. Well do the sums if you can and you get zero. A difference of zero means there is no difference, whatever word play you engage in.

Those who think securing the supply of a good by military means, by trampling on human rights or by any other abuse engaged in by resource companies does not reduce its price have a tenuous grasp on reality.

And as for those who hold up the corporate tax paid by exploration companies and its companies so well. country. That is the basic resource extraction model that has served the West extraction types here who think that it is not our gas it is their gas. They letting said company ship out the oil etc and the profits, greasing the necessary palms and giving only the bare minimum to the people of that royalty due to us for our gas. Ok, I guess there will be a lot of resource see nothing wrong with a country giving extraction rights to a company and to governments as some sort of "anti-subsidy", well that money is likely the

And there is no doubt that investors paying consumers to use natural gas (which is in effect what is happening in the US) really are subsidizing consumption.

"As I've said before, if you don't use words with their common meaning then nobody can trust a word you say."

Like "acidification" of a solution with a pH that is, and will remain, above 7?

Oops, that fourth para didn't turn out as intended, which was:

And as for those who hold up the corporate tax paid by exploration companies to governments as some sort of "anti-subsidy", well that money is likely the royalty due to us for our gas/oil. Ok, I guess there will be a lot of resource extraction types here who think that it is not our gas it is their gas. They see nothing wrong with a country giving extraction rights to a company and letting said company ship out the oil etc and the profits, greasing the necessary palms and giving only the bare minimum to the people of that country. That is the basic resource extraction model that has served the West and its companies so well.

@Chandra Dumpty

By this wordplay, employees' salaries are also a "subsidy" from their employer.

By this wordplay, investors have now decided to be charities instead. If not, you have your facts wrong ie natural gas is in fact making profits.

I explicitly said above that subsidies are not only in the realm of governments.

And yes, sometimes employers subsidise Christmas parties - i.e. the employees contribute some of the cost, and employers top it up. Or, sometimes they even pay for the whole thing. So what?

The point is, a subsidy is a transfer of real money from one party to another. If you get a discount for something you buy, it is not a subsidy. If your taxes are lower than someone else's, it is not a subsidy. If a company makes a loss and goes broke, it is not "a subsidy to consumers".

Pseudo-Marxist "economics" is beyond stupid.

No it isn't the model, nothing like it.

Every government , without exception, takes as much revenue from the resources industries as they can without strangling it. You can't milk a dead cash cow. Well, some do strangle it but they don't realise until too late, then they blame...foreigners, capitalists, anybody.

Johanna said, "If your taxes are lower than someone else's, it is not a subsidy". That is deliberately deceptive. We are not talking about the taxes of one being lower than those of others. There are many reasons why taxes (tax outcomes) can differ. We are talking about the tax rates applied to one being lower than the rates applied to another. This is a policy decision to favour one over the other, to make it more profitable for one to do business than the other. This is a subsidy.

Kellydown, no, resource nationalism is a relatively recent phenomenon. It is the result of countries having been robbed of their resources by greedy companies in the past.

This whole sham debate about subsidy is just the continuation of the same debate about AGW. AGW opponents, who are not scientists, oppose the science for reasons that have nothing to do with science. Their conspiracy minded approach leads them gradually to condemn larger and larger parts of the scientific community as corrupt or incompetent etc. As time goes on the conspiracy has to grow to include any group that accepts actions against AGW. Now it has extended into economics. AGW opponents are not economists, but now they know better than the IMF and the OECD. The whole world will soon be a conspiracy to cut your beloved carbon emissions.

DNFTT

The real take home for me, as I started critically reviewing my enviro/climate beliefs and assumptions, is that environmentalists lie. They lie consistently and with intent. They depend on lying to be successful. Few if any enviro groups do anything significant for the environment with the vast money they get from public donations and tax payers by way of government. Many enviro groups have more-than-equal standing in courts of law. Enviro groups depend on selling fear and false information to the public. Misdefining subsidy so as to hurt real producers and hide the failures of their ideas and supporters, like wind mills, is just a typical enviro movement ploy.

Chandra, countries mostly sell their resources on the same market that companies do. Countries either nationalise their resources industries or license private operators to do the work then tax the shit out of them . Most countries find the latter approach more beneficial.

Johanna, whether Chandra is a troll or not, he/she repeats enough common misconceptions to be worth answering. Kinda like Alan Davies on QI.

But not as funny ...

Chandra, your logic is one of obfuscation. By what bizarre logic do you derive the conclusion that not taking something from someone is a subsidy?

A subsidy is where a government pays for a product to be produced, irrespective of its value, and sold at a loss yet can be trumpeted as a profit, be it tractors or electricity. There is no way on God’s Earth that wind or solar PV can compete with other electricity production methods, in terms of cost; okay, the wind and PV companies are being “taxed”, but the only way they are actually “making” money is by draining it from the tax-payers (you and me) . Production of oil or gas is extremely expensive, and most governments have wisely left this process to private companies, then take a reasonable share from those companies for the benefit of the country (well, the government of that country, at least). There were side benefits, in that the private companies provide employment, and helped build the infrastructure. But that was done in the olden days, when governments were comprised of people who had actually been out in the real world, and understood a little about what they were doing. Nowadays, however, we have governments that contain very, very few who have been outside their cosy little bubble of politics, so have no understanding of such things as business. No – in their funny little worlds, what is required is that they take all the money that others make, shuffle it around, making sure that they and their friends get rich, and give some of the remainder out, lauding it loudly as their personal largesse. Anything that they do not take, they can still claim credit to, by calling it a subsidy. Take a look at my attempt to give a witty, insightful post up-thread (Dec 7, 2013 at 11:24 AM). All tax is legalised theft; NOT stealing is NOT a subsidy